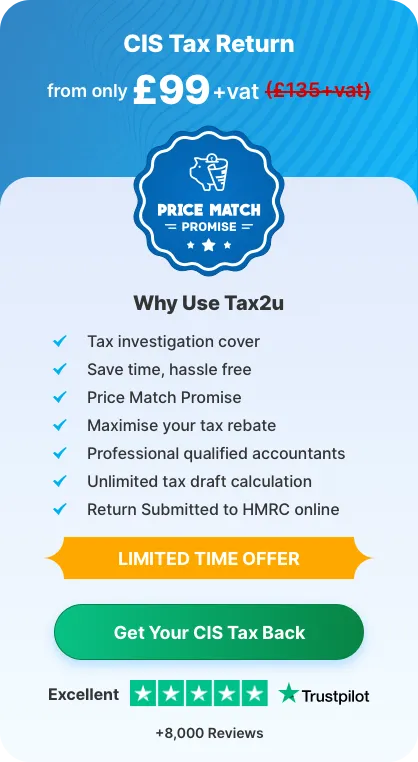

We work hard to make the process as simple as possible for you.

We will undertake all the calculations needed to work out your Income Tax and National Insurance contributions.

In order to do this, we need to confirm all your income and any tax that has already been deducted from your wages, as noted on your payslips.

Once we have all your income details confirmed we will:

- Undertake the tax calculations and advise you if you are due a tax rebate or if you are liable for any underpaid tax due to HMRC.

- Send your Draft Tax Estimate value for you to review.

- You will need to confirm payment terms and authorise Tax2u Ltd to represent you.

- We will submit your tax return to HMRC, and they will then process it, normally taking 2-3 weeks.

- On average, our clients receive around £2,514.

- If you made £12,570 this tax year, and you have been deducted 20% tax as you normally are if you are working under the CIS, 20% of £12,570 (Tax Free Allowance) is £2,514 in overpaid tax that we can claim back for you. This is just an example as we will also need to calculate what your National Insurance contribution will be.

- The 2023-2024 Tax Year is from 06/04/2023 to 05/04/2024 – we can help you claim any overpaid tax already deducted from your wages during this period.

- If your income is above the £12,570 tax threshold, it would help if you kept receipts for your work-related expenses (such as PPE & Tools, Transport, Bank Fees). These expenses will be used in the calculation to lower your taxable income.

Carmen

Carmen