Under HMRC’s Construction Industry Scheme (CIS) the Contractor has the responsibility to deduct 20% or 30% (depending on if you have a UTR or not) from the Subcontractors pay (normally an individual) – this is to ensure that they pay their Income Tax to HMRC every year.

The tax that the Contractor deducts from the individual through CIS is sent to the HMRC each month, as it would under PAYE. HMRC then allocates this as Income Tax to the individuals tax account.

At the end of the tax year on 5th April, HMRC will hold all the tax collected for the individual or Subcontractor. It is then the individuals responsibility to submit a Self-Assessment tax return to HMRC to confirm as follows:

- Total income (CIS, PAYE, Shares, Rental, other profits)

- Total business receipts (Expenses)

- Calculate their profit

- Calculate outstanding tax to be paid or reimbursed

HMRC will then advise if the tax collected throughout the year is more, or less than the final tax bill.

If the tax collected is more than what is due, then the individual (you) would be due a tax rebate.

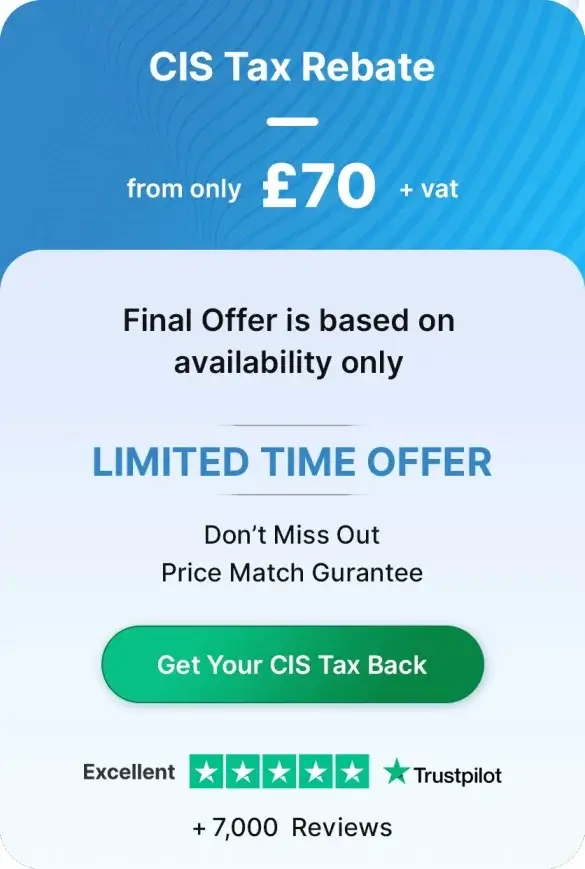

Tax2u has simplified this process and has helped thousands of clients reclaim their overpaid tax.

All we need is for you to upload your payslips and supporting documents onto our secure Online Dashboard. To get started click here to open your free Tax2u Online Dashboard, start uploading your files and be allocated your dedicated Accountant.

The best bit is that we will draft your return for free to find out if you are due tax back or not.

Carmen

Carmen