Self-Assessment is a system used by HM Revenue and Customs (HMRC) to collect Income Tax.

Income Tax is often deducted automatically from wages, pensions and savings, known as Pay As You Earn (PAYE). People and businesses with alternative income streams must report them in a Self-Assessment tax return.

If you registered as self-employed or have applied for a Unique Tax Reference (UTR) then you must submit tax return to HMRC every year, failure to do so can lead to serious fines and penalties. You can submit your tax return either online or by completing a paper form.

You will need to have kept records of your income and business expenses in order to submit your tax return. If you do not automatically receive monthly payslips from your employer, it is your employer’s legal duty to provide them so that you can submit your tax return, so make sure to ask them.

HMRC can charge you a penalty if your records are not accurate, complete and legible.

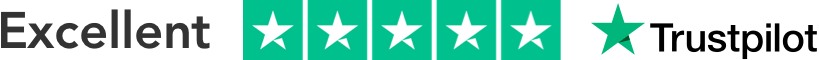

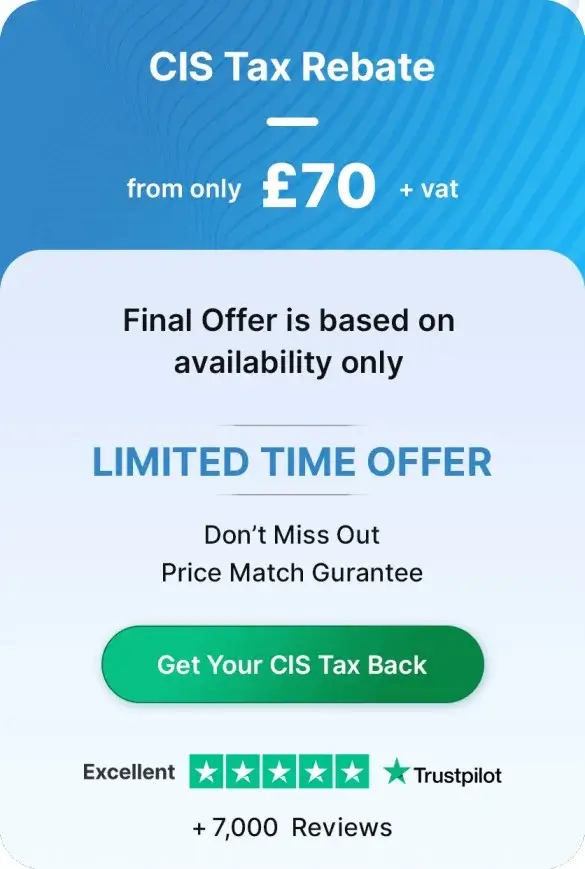

Tax2u are here to help get your tax return submitted to HMRC accurately and on time. Once you have sent us details of your income and expenses, it is time for you to sit back and relax while Tax2u does everything for you. Once we have submitted your tax return and HMRC have notified us of your rebate eligibility, we will get your tax rebate transferred to your account within 24hrs.

Carmen

Carmen