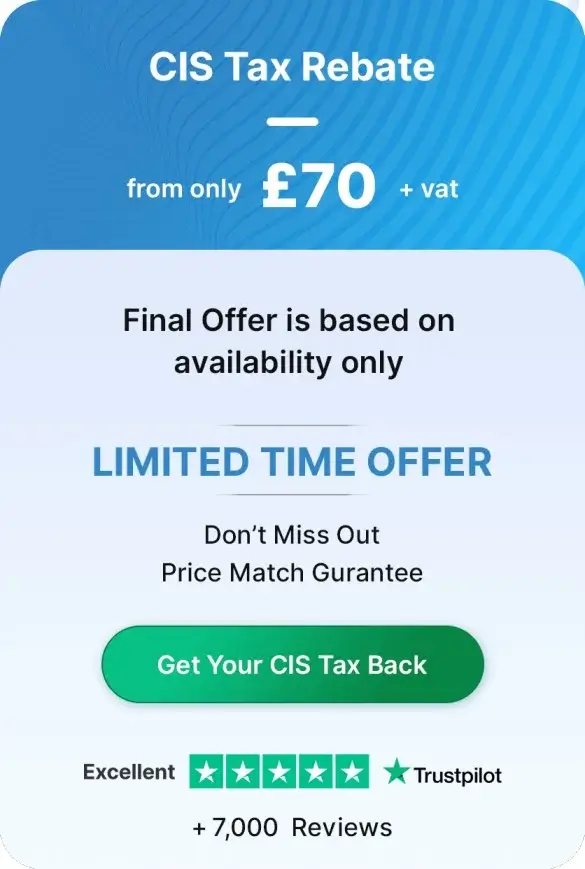

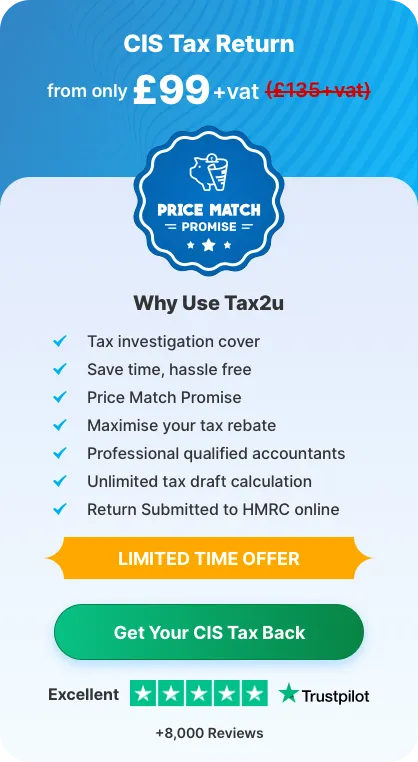

Claiming back your CIS tax with Tax2u could not be any simpler.

If you are working in construction industry and your employer deducted CIS tax from you, you are eligible to claim the CIS tax rebate. If you are CIS worker/subcontractor you’ll be given CIS deduction certificate by your contractor/client, this shows the amount of tax you were deducted by your contractor/client and paid to HMRC.

As self-employed, you must have to submit tax return every year after 5th April, in addition to submitting your self-assessment you can claim the CIS tax depending up on the earnings and CIS tax deductions throughout the year. Understanding the total income, claiming eligible expenses and CIS tax deduction calculations is a bit complicated.

It is highly recommended that you work with a professional CIS tax bookkeeper to make sure your CIS return information is accurate and fully legally compliant. If you claim too few expenses, you will not get the full refund you are due; but if you overinflate your expenses (even accidentally), you could face prosecution and large penalties.

Tax2u will calculate this for you and get your tax return submitted with HMRC. We provide a dedicated accountant to each client and our accountants will be in contact with each client until our clients get CIS tax rebates from HMRC.

Carmen

Carmen