Your payslips / invoices are the most important bit of information you need to keep.

However, you also need to keep your bank statements and business receipts (read here about business receipts).

Right now I’m going to tell you what your Payslip will look like and why it’s important.

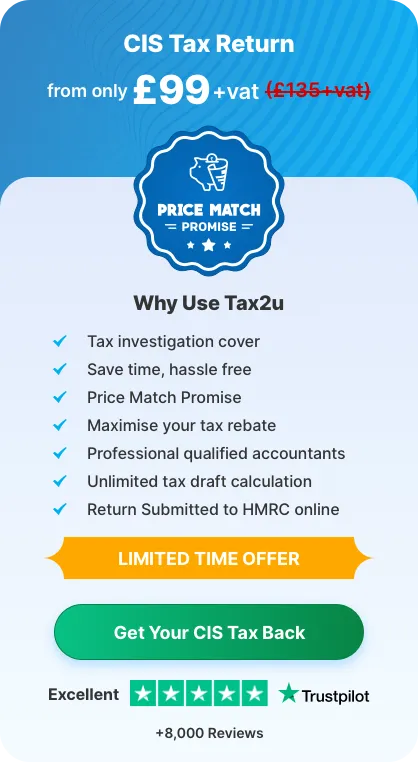

Your Client must issue you a CIS payslip every time they pay you. It’s a legal requirement and you must get this every month.

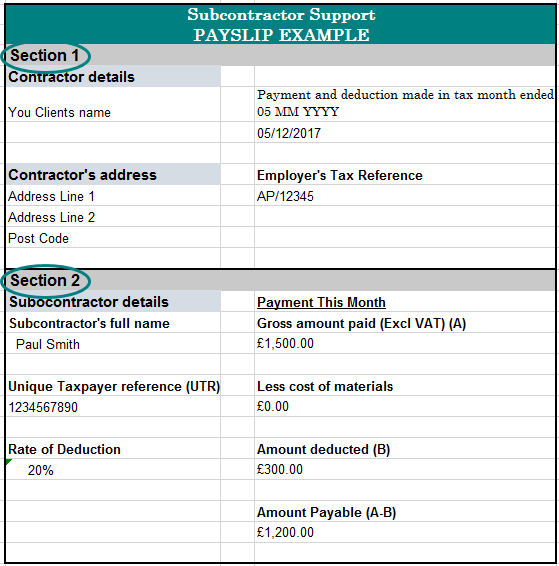

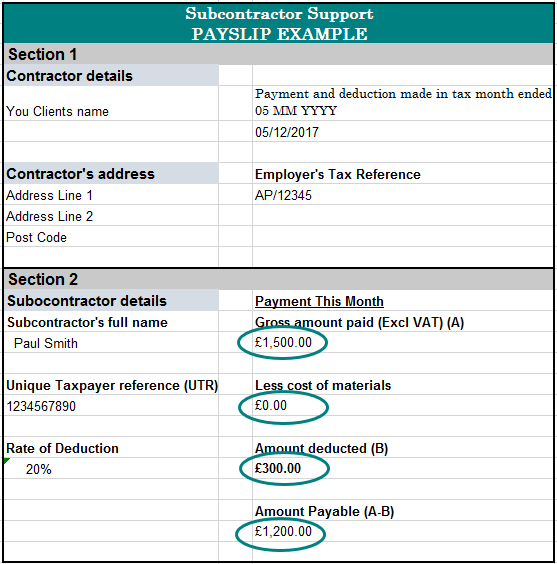

Generally, there will be two sections. (note: payslips come in different formats and this is just an example of the information it will have, don’t worry if yours doesn’t match exactly)

- Sections 1) Your clients information, name, address, their employers tax reference.

- Section 2) Your pay information

Section 2 is the most important section you need to be aware of and understand. This is all about how much you got paid and how much tax you have

had deducted from your pay.The image below shows the most important information. It’s from this information that we need to calculate and submit your tax return from. The information highlighted is:

Gross Payment – This is your pay before tax

Cost of Materials

– this is if you have supplied materials, if you are a labour only tax2u then you will not be supplying any materialsAmount Deducted

– this is the tax you have had deducted from this payment, depending on your yearly salary it’s likely you will be able to claim this back.Amount Payable – this is how much you should have received in your bank account.

Every payslip should show the tax you have had deducted from you. It’s this tax that we will try to reclaim. You are able to reclaim this tax because it doesn’t take into consideration your tax free allowance allowance you get each year. Click here to find out about your tax free allowance.

Send us your payslips to [email protected] so that we can assess how much tax you’ll be due back

Carmen

Carmen