WELCOME TO TAX2U

FREE INFORMATION YOU NEED TO KNOW!!!

Sign up now for

FREE pdf guide on how to maximise your CIS tax rebate

& save £100’s in tax

Tax return service £99+vat

DON’T PAY 30% TAX

GET YOUR UTR IN

ONLY 10 DAYS

WITH OUR FAST TRACK SERVICE

Your details are being uploaded

Only

£119+vat

(One Time Payment)

Limited places, first come first

Products Left: 2000/500

Offer End on: 6th April 2024

Only

£178+vat

(One Time Payment)

Limited places, first come first service

Products Left: 2000/2000

Offer End on: 30 Apr 2021

Only £ 12 + VAT

/ month

NORMALLY £20+VAT

Save £115

Simple, Straight Forward & Swift Tax Returns

We’ve made filing your tax return so easy for you

All you need to do is

Login

or Join Us

Check or Enter

your contact details

Upload your

documents

and we do the rest for you

To start or continue with your Tax Return please

enter your email address so we can identify if you

already have an account with us or not

We can see that you registered with us sometime ago but you haven’t signed up to an accounting plan yet.

We can see that you registered with us sometime ago but you haven’t signed up to an accounting plan with us

Where’s what 1,000’s of people are benefiting from having their tax return submitted by tax2u.co.uk with our GOLD accounting service

All completed online

-

Over 6,000 5* Reviews

-

£2,659 average rebates

-

Totally secure dashboard

-

48hr tax return submitted*

-

CIS Tax Rebate back in under 2 weeks

-

Dedicated Personal Accountant

-

24/7 Access to your dashboard

-

Simply upload your documents

-

Most competitive monthly service on the market

For a limited time only we are offering our GOLD yearly accounting service for the price of our SILVER PLAN

Only £12+vat per month

not £20+vat

Save £115

limited time offer

Once signed up we will start drafting your tax return straight away

Tax2u will draft and submit your tax return to claim back your tax.

You are agreeing for Tax2u to draft and submit your tax return on your behalf and the £288+vat fee to be deducted from your tax rebate.

If you’re tax rebate doesn’t cover the agreed fee then the balance will be payable before your tax return is submitted

No problem….

Start your tax return with us today

GREAT NEWS!!!

Only £12+vat per month

not £20+vat

Save £115

Where’s what 1,000’s of people are benefiting from having their tax return submitted by tax2u.co.uk with our GOLD accounting service

All completed online

-

Over 6,000 5* Reviews

-

£2,659 average rebates

-

Totally secure dashboard

-

48hr tax return submitted*

-

CIS Tax Rebate back in under 2 weeks

-

Dedicated Personal Accountant

-

24/7 Access to your dashboard

-

Simply upload your documents

-

Most competitive monthly service on the market

For a limited time only we are offering our GOLD yearly accounting service for the price of our SILVER PLAN

Only £12+vat per month

not £20+vat

Save £115

limited time offer

Once signed up we will start drafting your tax return straight away

Tax2u will draft and submit your tax return to claim back your tax.

You are agreeing for Tax2u to draft and submit your tax return on your behalf and the £288+vat fee to be deducted from your tax rebate.

If you’re tax rebate doesn’t cover the agreed fee then the balance will be payable before your tax return is submitted

To get started we need the following

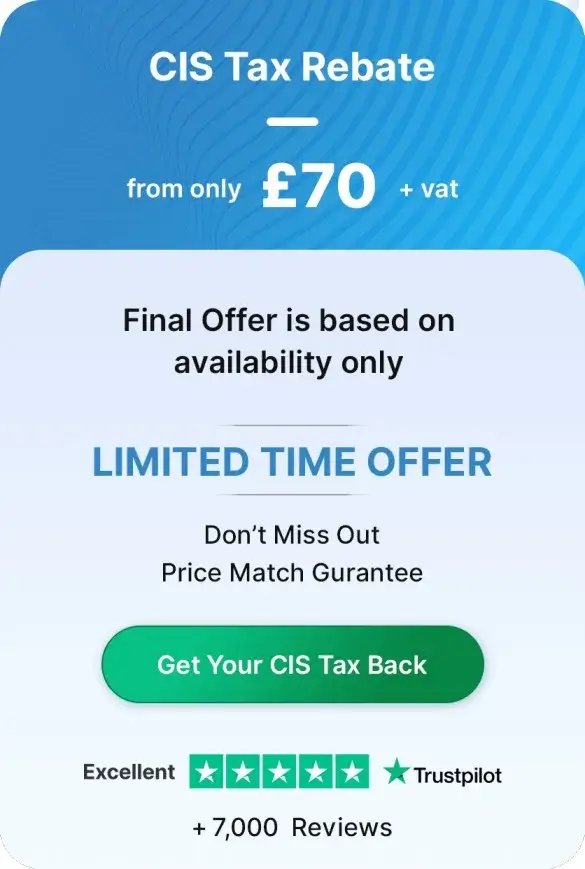

CIS Tax Rebate

Super Early Bird

Super Early Bird

Early Bird

Early Bird

Final Offer

Products Left: 2000/2000

Offer End on: 30 Apr 2021

Monthly DD

Final Offer

Tax Return Limited Time Offer

Super Early Bird

Super Early Bird

Find your self-assessment tax return advertised cheaper anywhere by qualified accountants and we’ll beat the price by 20%

To start or continue with your

Tax Return please enter your email address so we can identify if you already have an account

with us or not

We’ve made filing your tax return so easy for you

All

you need to do is

Login

or Join us

select

a service

Upload

some documents

and we do the rest for you

Rated 4.8/5 | 0ver 8,000 reviews

LIMITED TIME OFFER

From only

£135+vat

£99+vat

-for income is under £12k / tax year

-from 1 source of income

* the final price will depend on your yearly income, see prices

here

LIMITED TIME OFFER

For income is under £12k / tax year from 1 source of income

(22% of clients)

£135+vat

£99 + vat

For income £12k-£30k / tax year from up to 2 source of income

(41% of clients)

£178 + vat

Income is above 30k / tax year from up to 2 sources of income

(28% of clients)

£288 + vat

Time to upload your tax documents or email at [email protected]

Upload DocumentsUpload Documents section is only available for our paying customers

To get your Account Manager assigned and start working on your tax return, please join us

by making the payment

now

FREE INFORMATION YOU NEED TO KNOW!!!

Sign up now for

FREE pdf guide on how to maximise your CIS tax rebate

& save £100’s in tax

Tax return service £99+vat

THANK YOU FOR REGISTERING

WITH

You

have successfully unlocked your

50% Offer

Tax Return from £99+vat

£135+vat

Offer Ends in

We and our partners place cookies, access and use non-sensitive information from your device to improve our products and personalize ads and other contents throughout this website. You may accept all or part of these operations. To learn more about cookies, partners, and how we use your data, to review your options or these operations for each partner, visit our privacy center.

tax2u uses Hubspot and Hubspot is hosted on the Cloudflare server. : This cookie is set by HubSpot’s CDN provider because of their rate limiting policies. It expires at the end of the session.

This purpose is required by our website to operate normally and cannot be disabled. ( REQUIRED )

Cookies, identifiers of your terminal or other information may be stored or consulted on your terminal for the purposes presented to you.

Ensuring Secure Access to Tax Collection Services

Cookies, device identifiers, or other information can be stored or accessed on your device for the purposes presented to you.Learn More: Store and/or access information on a device

Essential to make the website function properly.

Ads can be personalised on the basis of a profile. Additional data can be added to further personalise the advertisements. Ad performance can be measured.

Ads can be shown to you based on the content you’re viewing, the app you’re using, your approximate location, or your device type.

A profile can be built about you and your interests to show you personalised ads that are relevant to you.Learn More: Create a personalised ads profile

Personalised ads can be shown to you based on a profile about you

Personalised ads can be shown to you based on a profile about you

The content can be personalised on the basis of a profile. Additional data can be added to further personalise the content. Content performance can be measured. Information can be generated on which audiences have seen the ads and content. Data can be used to create or improve user experience, systems and software.

Let tax2u use the preferences you have defined to contact you in a relevant way.

We use cookies to collect anonymous usage statistics to improve our website's performance and user experience

Essential to make the website function properly.

Personalised content can be shown to you based on a profile about you.Learn More: Select personalised content

The performance and effectiveness of content that you see or interact with can be measured.Learn More: Measure content performance

Market research can be used to learn more about the audiences who visit sites/apps and view ads

Your data can be used to improve existing systems and software, and to develop new productsLearn More: Develop and improve products

Your data can be used to improve existing systems and software, and to develop new products Learn More: Develop and improve products

We Use Cookies to Improve Your Experience and Provide Relevant Tax Collection Services Data

By giving consent to the purposes above, you also allow this website and its partners to operate the following data processing: Ensure security, prevent fraud, and debug, Link different devices, Match and combine offline data sources, and Technically deliver ads or content

Some cookies are needed for technical purposes, they are therefore exempted from consent. Others, non-mandatory, may be used for personalized ads and content, ad and content measurement, audience insights and product development, precise geolocation data, and identification through device scanning, store and/or access information on a device. If you give your consent, it will be valid across all tax2u subdomains. If you refuse cookies, you will not be able to use the chatbot on the tax2u console. You can withdraw your consent at any time by clicking on consent choices at the bottom right of the page. To learn more, visit our privacy center.